The gaming industry remains a resilient hub of innovation and growth, as evident in the latest findings from Newzoo’s Global Games Market Report 2024. With a comprehensive analysis of the PC, console, and mobile gaming markets, the report paints a promising picture of the industry’s future.

In the current year, Newzoo has enhanced this segment by integrating data from the Global Gamer Study, Newzoo’s comprehensive gamer research product. This study surveys over 73,000 respondents, ranging from 10 to 65 years old, across 36 key countries and markets. The insights gleaned from this study contribute to our in-depth comprehension of consumer behaviours related to gaming, including their play patterns, spending habits, and motivational factors.

Source: Newzoo’s Global Games Market Report 2024

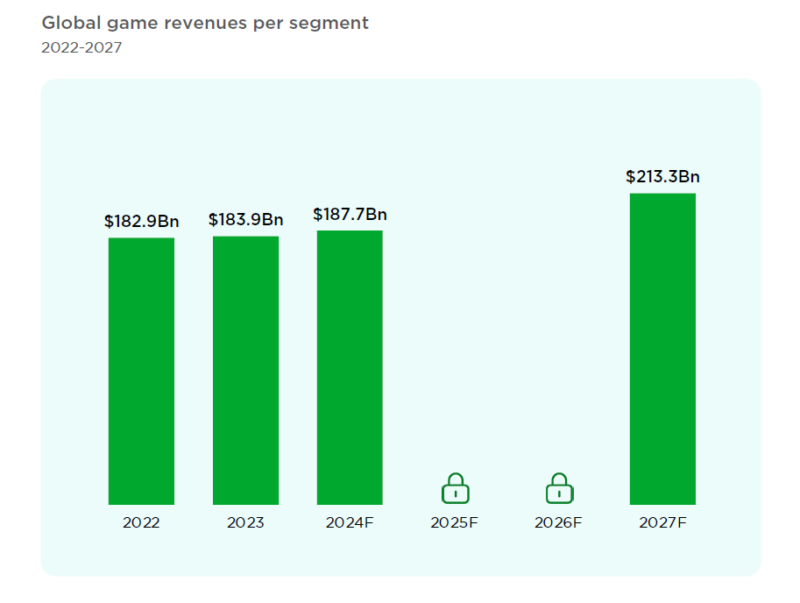

Global game revenue

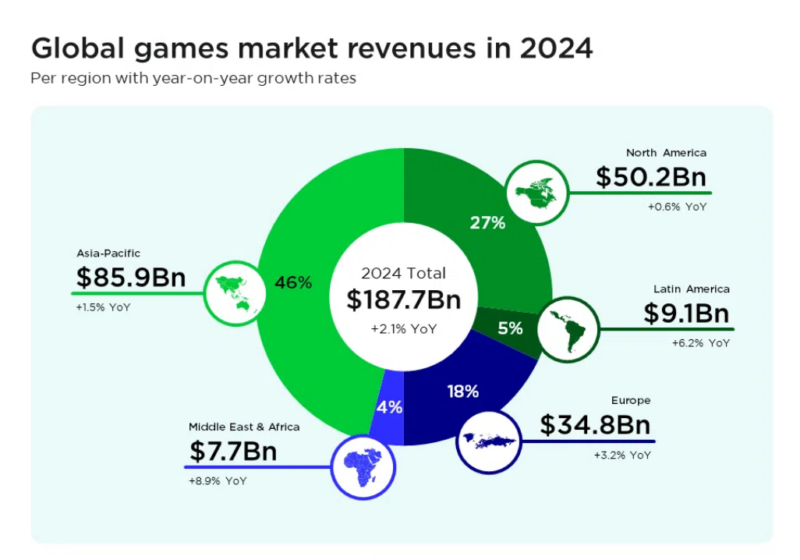

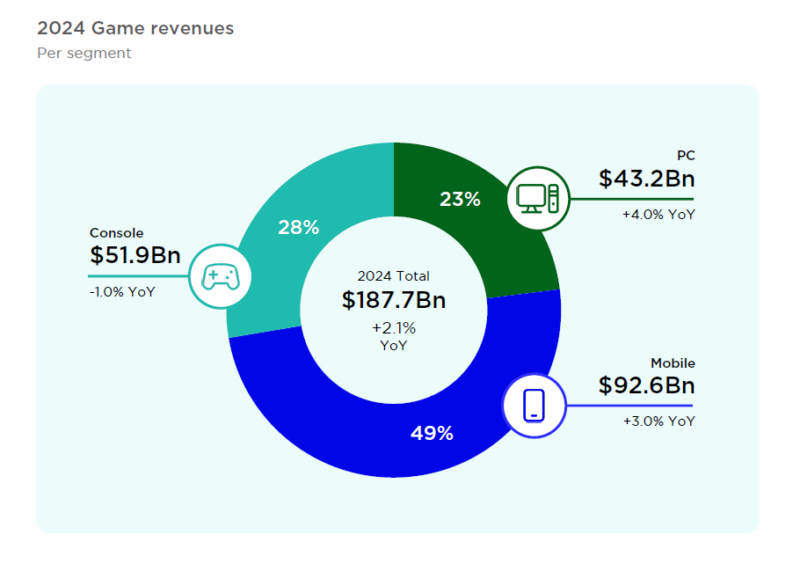

In 2024, the global games market is projected to generate revenues of $187.7 billion, marking a +2.1% year-on-year growth. PC revenues are expected to outpace mobile and console revenues this year, with the PC segment forecasted to increase by +4.0% year on year to $43.2 billion. The mobile gaming sector is still adjusting to changes in the mobile market, particularly related to privacy-driven monetization and user-acquisition challenges. Notably, live-service titles like League of Legends, Fortnite, and Counter-Strike continue to maintain significant popularity, capturing a growing share of playtime and subsequent spending. Games-as-a-platform titles such as Roblox and Fortnite are also evolving and attracting an expanding audience, especially among Gen Z and Alpha demographics.

Key insights from the report reveal a robust +2.1% year-on-year growth in the global games market in 2024, with an estimated revenue of $213.3 billion projected for 2027.

Source: Newzoo’s Global Games Market Report 2024

Notably, North America is set to generate $50.2 billion in game revenues in 2024, underscoring its significant role in the global gaming landscape. North America will also maintain its significance, accounting for 27% of all market revenues, with the US contributing $47.0 billion to the global total. Looking ahead to 2027, the report forecasts a robust growth trajectory for the global games market, with revenue figures expected to reach $213.3 billion.

Source: Newzoo’s Global Games Market Report 2024

Global players

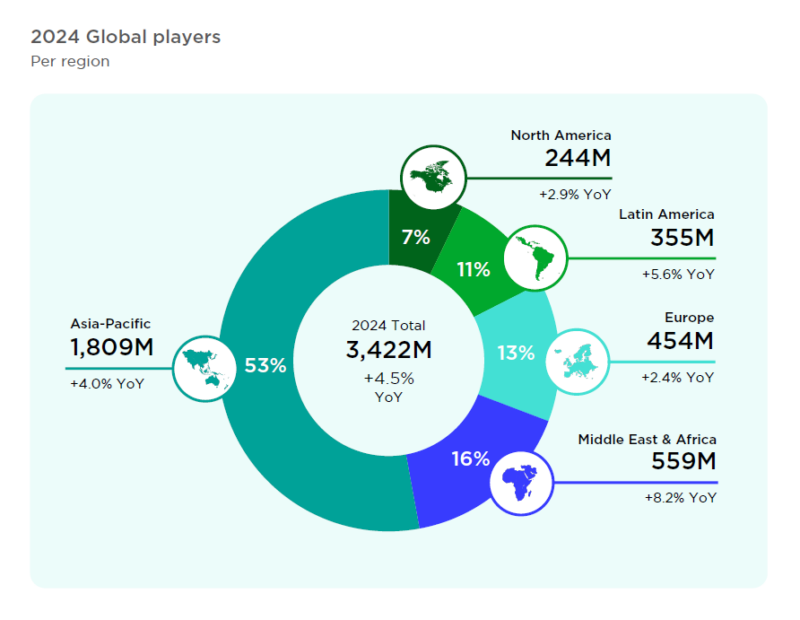

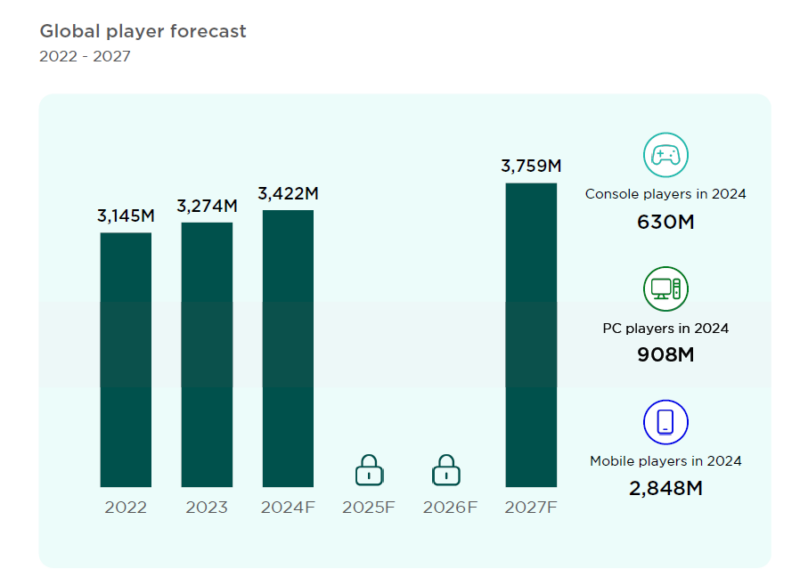

In 2024, the global player base is expected to reach 3.42 billion, reflecting a +4.5% year-on-year increase, primarily driven by the growth of PC players. With a strong 2023 release slate, PC player numbers are projected to grow by +3.9% annually, exceeding 900 million. Meanwhile, console player growth has slowed to +2.3% due to a relatively thin content pipeline in 2024. Mobile player growth is estimated at +3.5% annually, reaching 2.85 billion by 2024, largely influenced by expanding smartphone accessibility and mobile networks in emerging markets. Despite a decline in average playtime since the peak of the pandemic, the total player base is anticipated to grow to 3.76 billion by 2027, with each segment’s annual growth ranging from +2% to +4%, emphasizing the significance of effective player conversion and retention.

Player numbers across all markets are expected to increase. Asia-Pacific, which currently houses 53% of global players, is projected to experience a +4.0% year-on-year growth, reaching 1.8 billion players in 2024, driven mainly by Central and Southeast Asian markets. Meanwhile, the mobile-first Middle East & Africa and Latin America, representing 16% and 10% of global players, will continue to exhibit higher growth rates compared to other regions. North American and European player growth is anticipated to amount to +2.9% and +2.4% year on year, respectively.

Source: Newzoo’s Global Games Market Report 2024

The report also sheds light on the anticipated growth in the PC and console markets, driven by the release of new gaming devices and highly-anticipated titles, instilling a sense of optimism about the industry’s future.

Source: Newzoo’s Global Games Market Report 2024

It poses thought-provoking questions for developers and publishers, urging them to confidently balance investment in compact gaming experiences versus sprawling games, sustain the free-to-play model, harness the potential of generative AI tools, and make strategic decisions about established IPs versus innovative ventures.

Examining market growth, the report indicates that while the gaming market is slowly and steadily expanding, industry players must navigate cost control in an increasingly consolidated market. With cautious optimism for the gaming industry in the coming years, the report unfolds detailed estimates and forecasts to comprehensively understand the market’s trajectory.

Segmenting global revenue, the report highlights that PC and console game revenues are set to account for 51% of the global market revenues, with PC revenue growth surpassing the mobile and console segments in 2024.

Source: Newzoo’s Global Games Market Report 2024

Mobile app ecosystems

Mobile app ecosystems are undergoing significant changes due to new regulatory legislation, prompting companies like Apple and Google to allow alternative app marketplaces and payment methods. The European Union’s Digital Markets Act (DMA) has particularly influenced this shift, compelling major mobile platforms to open their storefronts. This change raises questions about its implications for developers and consumers, the beneficiaries of a more open ecosystem, and the broader impact on the mobile gaming market.

Virtual reality (VR) in 2024

The current landscape of virtual reality (VR) in 2024 In recent years, the trend in virtual reality (VR) gaming has closely aligned with the overall games market. Consumers have redirected their time and entertainment expenditures away from home-based activities, resulting in decreased time and financial resources allocated to gaming. Although VR represents a growing market, it encounters several challenges, particularly in retaining newly acquired users and sustaining their engagement. Escalating inflationary pressures continue to constrain consumer budgets, rendering investments in new hardware impractical.

Additionally, the limited availability of exclusive content poses a significant obstacle to broader adoption. Conversely, the release of Vision Pro by Apple and Quest 3 by Meta has reignited both enterprise and consumer interest in VR, occurring alongside increased investments by tech industry giants in the technology. The special focus topic #1 presents our most recent VR statistics, explores the strategies of key players in the VR sector, and highlights upcoming developments in VR, augmented reality (AR), and the intersection of both, known as mixed reality (MR). These combined markets are collectively referred to as extended reality (XR).

Generative AI in Gaming

Revisiting Generative AI in Gaming Towards the end of 2022, OpenAI introduced ChatGPT to the public, sparking widespread excitement and apprehension on a global scale about generative AI tools. While the gaming industry embraced this technology with some reservations, last year’s Global Games Market Report delved into the industry’s response to the sudden surge in generative AI.

The report explored the use cases of generative AI in game development, its positive and negative impacts, and the prominent discussions around job displacement, IP infringement, and content quality within developer and fan communities. In the time since, generative AI technology has rapidly evolved, compelling not only the gaming industry but virtually every sector to grapple with profound questions about the future of work and creativity.

The authors of the report believe that the current impact of generative AI is incremental, functioning as a catalyst for human creativity and development expertise rather than a complete substitution.

The report extensively explores the risks and limitations of the technology and projects its potential impact in the years to come. This comprehensive trend covers: – Major and minor generative AI opportunities for game developers in 2024, including an in-depth analysis of on-device processing. – Use cases of generative AI for AAA developers and indie studios, shedding light on the operational aspects of game makers of varying scales. – The limitations and risks associated with integrating generative AI tools in game development.

In the conclusion:

- The global games market is projected to generate $187.7 billion in 2024, reflecting a +2.1% year-on-year growth.

- The number of global paying gamers is expected to increase by +5.0% to 1.50 billion in 2024, with a further rise to 1.67 billion by 2027.

- The total number of players globally is forecasted to reach 3.42 billion in 2024, marking a +4.5% year-on-year increase, primarily driven by PC player growth.

- PC revenues are anticipated to grow by +4.0% year-on-year to $43.2 billion, surpassing mobile and console revenues for the year, before roles reverse in 2025.

- The mobile gaming sector, responsible for 48% of the global revenues in 2024, is expected to grow by +3.0% year-on-year to reach $92.6 billion.

- The overall market is projected to achieve a CAGR of +3.1% between 2022 and 2027, reaching $213.3 billion in 2027.