As we look ahead to 2024, programmatic advertising is poised for significant shifts. The latest “Future of Programmatic 2024” report by WARC, in partnership with NewtonX, highlights five critical trends that will define the landscape over the next 12 months. With input from 100 programmatic experts, this report sheds light on the challenges and opportunities, from brand safety to the evolving role of third-party cookies.

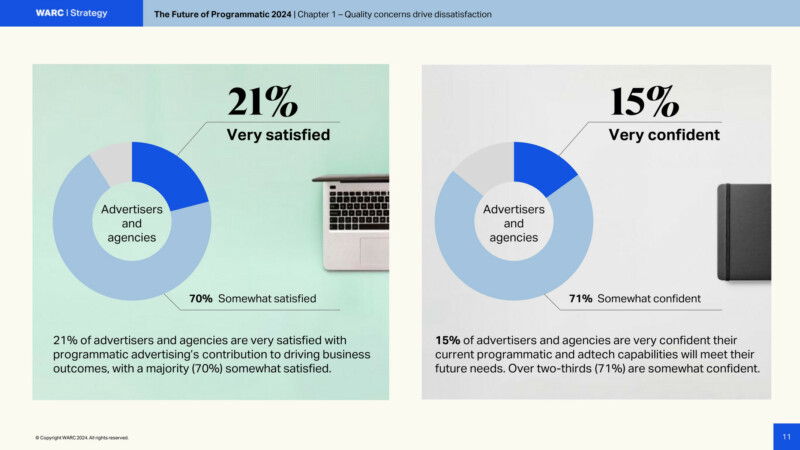

21% of advertisers and agencies are delighted with programmatic advertising’s contribution to business growth, while 70% are somewhat satisfied.

Source: WARC The Future of Programmatic Report 2024

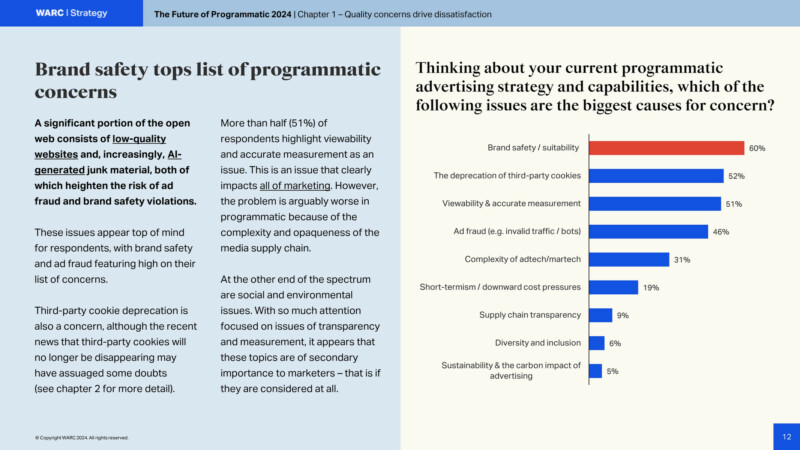

Brand Safety Takes Center Stage

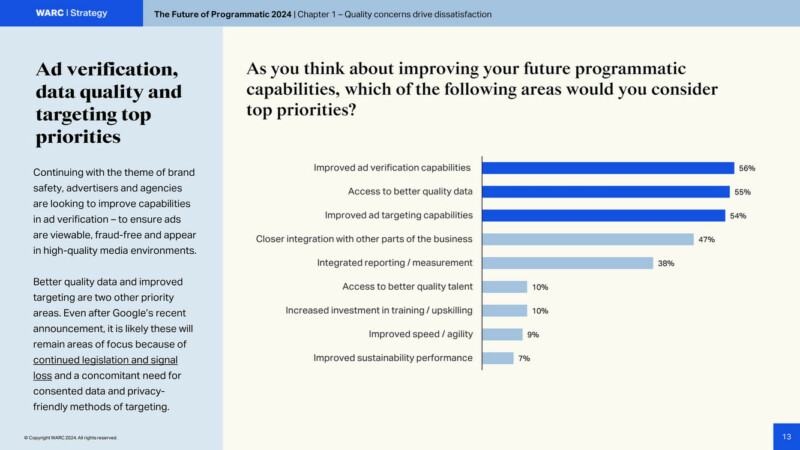

Brand safety has always been a concern, but it’s now at the forefront of advertisers’ minds. According to the report, 60% of advertisers and agencies consider brand safety their top concern. Recent studies have shown that millions of dollars are wasted on low-quality ad placements, some displayed alongside harmful or inappropriate content. As brands become increasingly aware of the potential damage to their reputations, the demand for improved ad verification capabilities is growing. 56% of surveyed identified this as a top priority for the coming year.

Source: WARC The Future of Programmatic Report 2024

Over half of the advertisers and agencies surveyed identify brand safety as a major concern, with 56% prioritizing the improvement of ad verification capabilities.

Source: WARC The Future of Programmatic Report 2024

Navigating a Cookie-Diminished World

The digital advertising landscape is still grappling with the implications of a world where third-party cookies are no longer the dominant tool for tracking and targeting. While Google has decided not to fully phase out third-party cookies, their role is undeniably diminishing. This transition is causing significant concern among advertisers, with many feeling unprepared for the challenges ahead. Only 25% of respondents believe they are making adequate progress in adapting to this new reality, particularly in targeting, data access, audience segmentation, and measurement. However, there is a silver lining: over 76% of respondents proactively implement first-party data strategies, a crucial step in navigating this more privacy-focused environment.

Transparency Remains Elusive

Despite the industry’s acknowledgement of the need for greater transparency in the programmatic supply chain, progress has been slow. The ANA’s report last year highlighted significant inefficiencies and waste, yet many advertisers and agencies have yet to take meaningful action. Currently, only 28p of every pound spent on programmatic advertising reaches the consumer, with a quarter of the £67 billion allocated to open web programmatic ad spend being wasted on low-quality and fraudulent impressions. The lack of transparency impacts ROI and erodes trust in the programmatic ecosystem.

The Overlooked Issue of Emissions Reduction

As the world grapples with the climate crisis, the programmatic advertising industry’s carbon footprint is being scrutinised. Programmatic advertising is energy-intensive, particularly due to the complexity of its supply chain. Yet, emissions reduction is not a priority for most companies, with 59% of respondents admitting that they have not adopted any framework or methodologies to measure the carbon emissions from their digital advertising campaigns. This lack of action is concerning, especially considering that the programmatic industry produced more than 215,000 metric tons of carbon emissions in a single month across five leading economies. However, there is hope on the horizon, as some advertisers are beginning to use media agencies to forecast carbon emissions, integrating sustainability into their media planning processes.

Shift in Investment from Open Web to Walled Gardens

Another significant trend is the shift in advertising spend from the open web to walled gardens like Meta, Google, and Amazon. Despite evidence that the open web remains where audiences spend most of their time, advertisers are increasingly funnelling their budgets into these closed ecosystems. The report reveals that 76% of respondents are now spending 40% or less of their budgets on open web advertising, which is expected to decrease further in 2024. WARC predicts that just five platforms will dominate global advertising spend by the end of the year, raising concerns about market concentration and the implications for competition and innovation.

Preparing for the Future

As programmatic advertising continues evolving, the industry faces challenges and opportunities. In 2024, advertisers and agencies will need to address brand safety concerns, adapt to a cookie-diminished world, enhance transparency, prioritize sustainability, and balance investments between the open web and walled gardens.

The “Future of Programmatic” report underscores the importance of staying agile and proactive. As Paul Stringer, WARC’s managing editor of research and insight, aptly notes, “Declining addressability, brand safety, and ad fraud continue to concern marketers, and addressing these concerns becomes even more important as increasing volumes of spend are transacted programmatically each year.”

For those invested in the future of programmatic advertising, these trends offer a roadmap for navigating the complexities of the digital advertising landscape in 2024 and beyond.

Download the full version of WARC The Future of Programmatic 2024 Report here.

Source: WARC The Future of Programmatic Report 2024