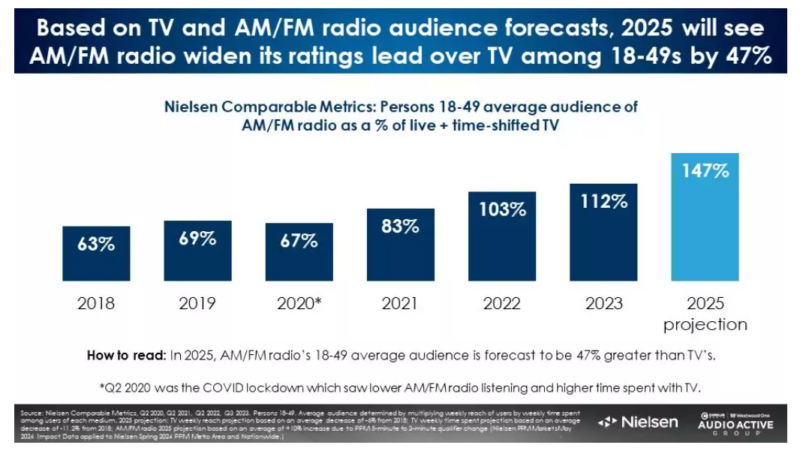

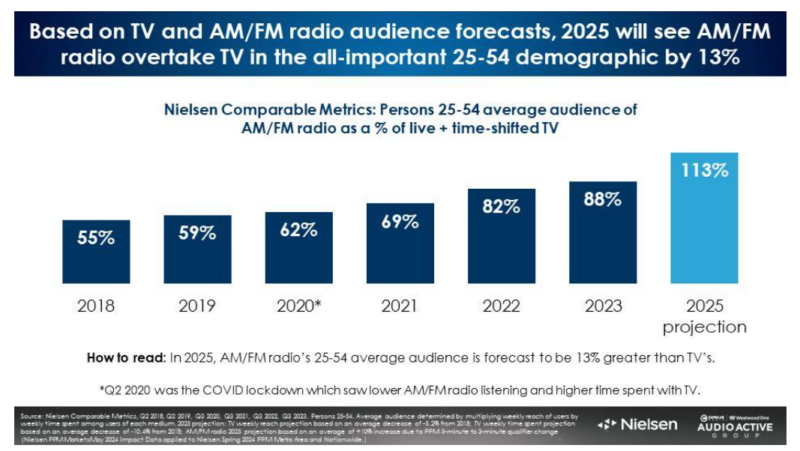

The shift of AM/FM radio surpassing TV in ratings is set to accelerate. Over the past five years, AM/FM radio has consistently outperformed linear TV. By 2023, AM/FM radio’s ratings for the 18-49 demographic were 12% higher than TV. The gap in the 25-54 age group has also been narrowing. By 2025, AM/FM radio is projected to surpass TV in the crucial 25-54 demographic by 13% and expand its lead over TV in the 18-49 demographic by a significant 47%.

At a time when AM/FM radio is already poised to surpass TV in the coveted 25-54 demographic, Nielsen’s enhancements—such as shifting the quarter-hour listening credit from 5 minutes to 3 minutes—are set to boost audience ratings further. For advertisers, this means more accurate audience measurements and better campaign outcomes, particularly for those leveraging the power of audio in their media strategies.

Network radio advertisers often evaluate how impressions are distributed across major markets. PPM markets typically show lower listening levels compared to diary markets due to more precise measurement by the Portable People Meter.

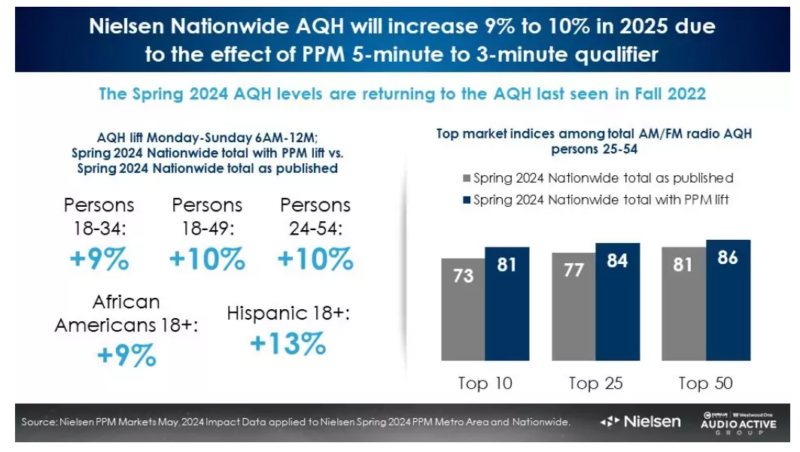

Currently, 25-54 listening in the top 50 markets is 19% lower than the national average, but this gap reflects the accuracy of PPM data. By 2025, this difference is expected to narrow to 14%.

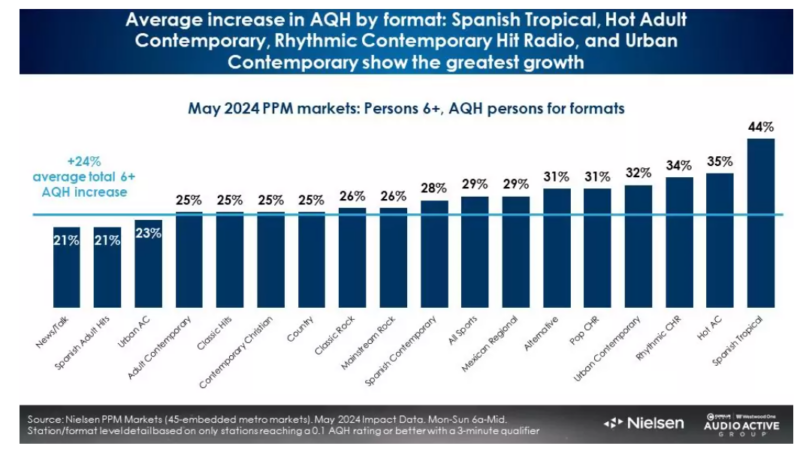

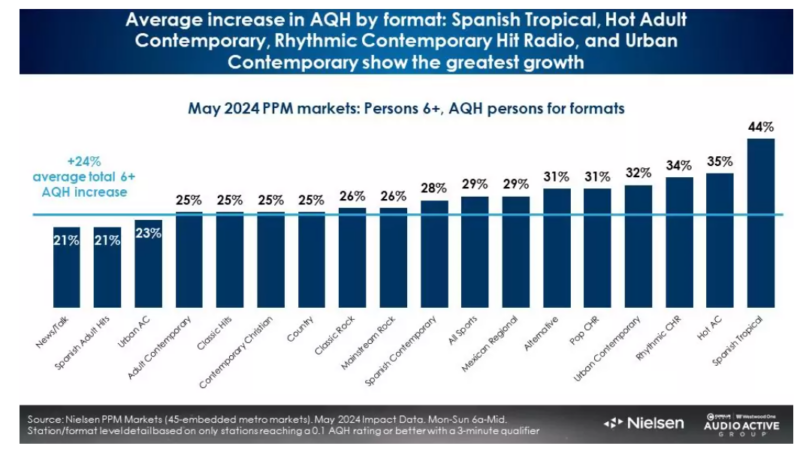

Top markets will see notable growth in AQH listening, with an 8-point increase in the top 10 markets and 5-6 points in the top 25 and 50. Formats like Spanish Tropical, Hot AC, and Urban Contemporary will lead in audience growth.

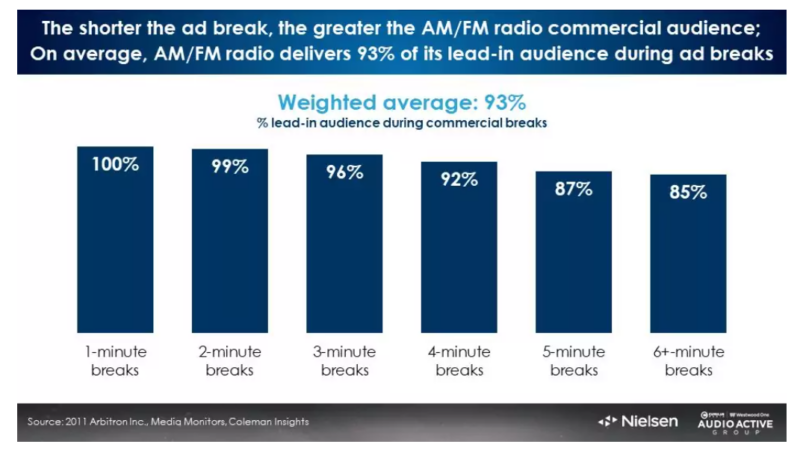

AM/FM radio ads are set to become more effective as stations introduce more frequent commercial breaks with shorter durations. Currently, most AM/FM stations schedule two commercial breaks at :15 and :45 past the hour to optimize 5-minute listening durations. However, with the new 3-minute quarter-hour qualification, stations can increase the number of shorter breaks, providing significant advantages for advertisers. A comprehensive Portable People Meter study conducted by Nielsen, Media Monitors, and Coleman Research analyzed 17,896,325 unique commercial breaks over 61,902,473 minutes of advertising. The findings indicate that shorter ad breaks lead to higher audience retention, enhancing the overall impact of radio advertising.

Two-minute ad breaks retain 99% of the lead-in audience, while six-minute breaks retain only 85%. By implementing more shorter ad breaks, stations can attract larger commercial audiences, allowing advertisers to stand out more effectively. Increasing audience delivery for AM/FM radio ads enhances marketing effectiveness and drives sales growth.

The “5 minutes of listening equals a quarter-hour” rule has been in place since the 1960s, originally established by Arbitron’s AM/FM radio measurement service. This rule continued even after the introduction of the Portable People Meter in 2010.

Recent analysis shows that 23% of AM/FM radio listening occasions last just three or four minutes, which currently go uncredited under the existing rules. Nielsen suggests that these short listening durations should be included in PPM market reporting.

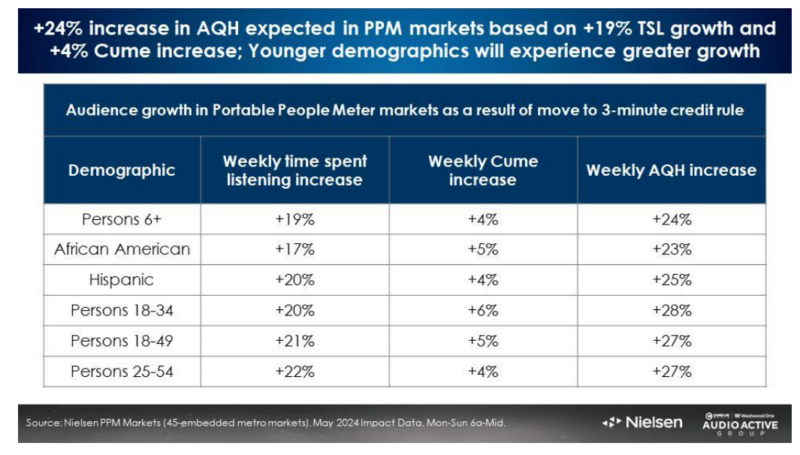

As a result, PPM markets are expected to see a +24% increase in average quarter-hour (AQH) listening, driven by a +19% increase in time spent listening (TSL) and a +4% growth in cumulative audience. Younger demographics are projected to experience even greater growth.

Total U.S. AM/FM radio listening is projected to increase by +10% in 2025.

Network radio advertisers rely on Nielsen’s national audience service, known as “Nielsen Nationwide.” Scott Anekstein, VP of Research at Westwood One, performed a national AQH projection by integrating data from the enhanced Portable People Meter (PPM) markets and existing diary markets, which represent approximately one-third of the total U.S. population.

He combined Nielsen’s PPM AQH audiences with the May 2024 reprocessed tuning based on the new 3-minute edit rule and the diary audiences from the Spring 2024 Nationwide survey.

Comparisons with the reprocessed data indicate:

- Total U.S. AQH listening for the 18-49 and 25-54 age groups is expected to grow by +10%.

- Listening among individuals aged 18-34 and African Americans aged 18 and older is projected to increase by +9%.

- Hispanic audiences aged 18 and older are forecasted to rise by +13%, reflecting their larger presence in the Portable People Meter markets.

Spanish Tropical, Hot Adult Contemporary, Rhythmic Contemporary Hit Radio, and Urban Contemporary are poised for significant average quarter-hour audience growth.

AM/FM Radio Surpassing TV: AM/FM radio has outpaced linear TV ratings over the past five years. As of 2023, its 18-49 ratings were 12% higher than TV. By 2025, AM/FM radio is projected to exceed TV ratings in the crucial 25-54 demographic by 13% and widen its lead among 18-49s by 47%.

Post-Buy Analyses for 2025: PPM markets may see audience deliveries increase by up to +24% compared to 2024. Overall U.S. media plans are expected to grow by +10%, depending on demographic, market, and programming format mix.

Reach Growth in Advertising: AM/FM radio, already the leading mass reach medium, anticipates a +7% daily reach and +4% weekly reach growth, enhancing advertising effectiveness and supporting marketers’ sales.

For AdTonos, which specializes in dynamic, real-time audio ads, this increase in radio listening provides a compelling opportunity. The growth in daily and weekly reach for AM/FM radio not only supports stronger ad effectiveness but also allows advertisers to reach wider and more engaged audiences. The changes will also encourage stations to offer shorter, more frequent commercial breaks, which is expected to enhance ad retention and improve marketing results.

This evolution of the AM/FM landscape underscores the growing influence of audio advertising and its ability to drive performance. As programmatic audio platforms continue to innovate, tapping into the enhanced reach and performance of AM/FM radio will be a critical advantage for brands aiming to connect with audiences in meaningful ways.

Stay tuned to see how these advancements shape the future of audio advertising and how AdTonos is helping brands leverage these trends for maximum impact.